I’ll let you in on an open secret: Lisa Cook wasn’t fired for mortgage fraud

She’s being fired because she’s the perfect symbol of woke excess.

On August 27, President Donald Trump did something no president had ever done before: he fired a sitting Federal Reserve governor mid-term.

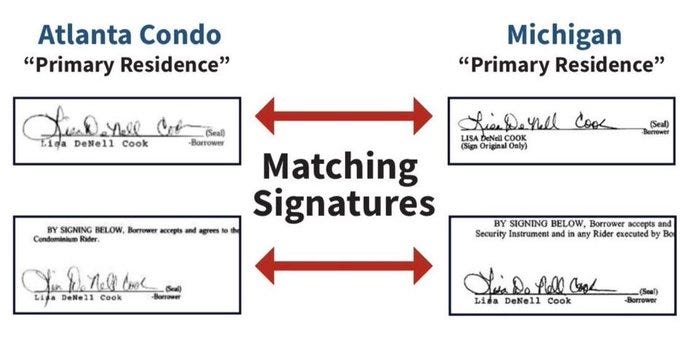

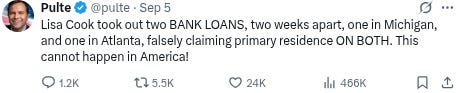

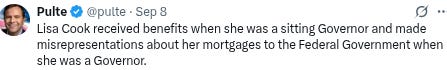

The official reason? “Mortgage fraud.” Cook allegedly listed two different houses as her “primary residence” to secure better loan terms. A technical violation, embarrassing for the Fed. We’re supposed to be scandalized.

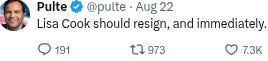

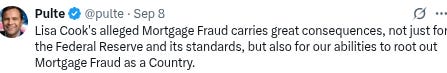

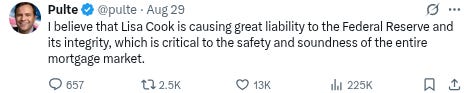

Bill Pulte, director of the Federal Housing Finance Agency and chairman of Fannie Mae and Freddie Mac, is spearheading the effort to take down Cook.

But let’s be honest: mortgage fraud is just a fig leaf.

I know it.

Bill Pulte knows it.

Everyone inside the Trump administration knows it.

The only people who aren’t supposed to know are you.

Here’s the truth: more than a year before Cook’s mortgage paperwork surfaced, I spoke with a senior Trump administration official who told me outright they were already looking for a way to push her out.

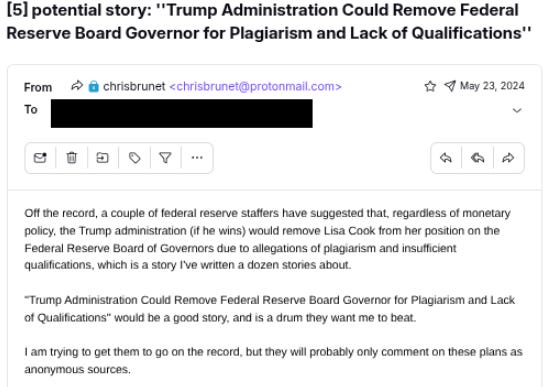

Back in May 2024, I even pitched a magazine story titled: “Trump Administration Could Remove Federal Reserve Governor for Plagiarism and Lack of Qualifications.”

That pitch had nothing to do with mortgages. It was about Cook’s academic record, her credentials, and the Washington consensus that she’d been elevated to the Fed as a pure diversity hire.

The editors passed, calling it “too speculative.”

But that was the conversation in Washington: how to get rid of Lisa Cook—not for a box checked wrong on a loan application that saved her 5bps on a loan, but because she embodied everything the administration wanted to make an example of.

Now, fast-forward a year, the White House has manufactured its thin pretext, and it’s much thinner than you think: members of Trump’s own Cabinet pulled the same tricks Cook is accused of, yet none were fired. None faced media outrage, and all denied wrongdoing—just as Lisa Cook has.

Labor Secretary Lori Chavez-DeRemer ‘‘entered into two primary-residence mortgages in quick succession, including for a second home near a country club in Arizona, where she’s known to vacation.’’

Transportation Secretary Sean Duffy ‘‘has primary-residence mortgages in New Jersey and Washington, D.C.’’

Lee Zeldin, the Environmental Protection Agency administrator, ‘‘has one primary-residence mortgage in Long Island and another in Washington, D.C., according to loan records.’’

Even Pulte’s own father and stepmother, Mark and Julie Pulte, claimed homestead tax breaks in both Michigan and Florida at the same time, and even rented out one of those supposed ‘‘primary residences,’’ according to Reuters and tenant records. After Reuters contacted tax officials in Bloomfield Township, Michigan, to inquire about the dual claims, Darrin Kraatz, director of assessing, confirmed the township would revoke the exemption on the Pultes’ residence.

So, while Pulte clutched his pearls online as the sheriff of Trump’s housing market, yelling that nobody will get away with renting out their primary residences, his own father was pocketing rent checks on a property he simultaneously claimed as a primary residence. Classic.

Trump himself has played the same game. New York’s Attorney General famously accused him of inflating asset values to secure cheaper loans, and a judge eventually ordered him to pay hundreds of millions of dollars in penalties after finding that his company had used false financial statements to obtain cheaper loans.

That was lawfare, and so is this. The right is finally playing the game.

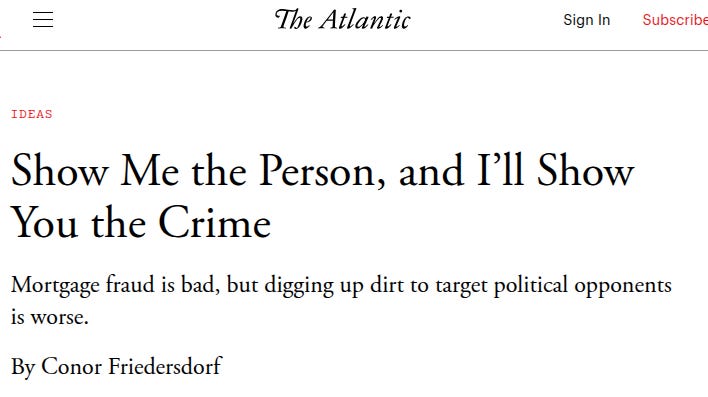

If mortgage fraud were truly disqualifying, Washington would be a ghost town. As The Atlantic recently put it, in defense of Lisa Cook: “How many members of Congress, federal judges, governors, attorneys general, and other federal and state leaders have submitted home-loan applications with falsehoods in them? Too many, I think, to make felons of them all.”

At first I dismissed The Atlantic’s defense of Cook.

But the more I look, the more their point seems valid.

As that article points out, a 2023 study by Ronel Elul of the Federal Reserve Bank of Philadelphia found that so-called “occupancy fraud”—pretending to be an owner-occupant to score a better mortgage rate—is rampant. One out of every three real-estate investors does it, and while they default more often, almost none are punished. Even when clear mortgage fraud has taken place, it almost always leads to an out-of-court settlement, with fees paid to the lender, rather than a criminal case. In 2024, only 38 people in America were sentenced for mortgage fraud.

Clearly, the Cook case isn’t about enforcing the law.

It’s red meat for the base.

It’s about manufacturing a pretext to crush the woke. Trump became a folk hero by attacking the woke, and for Trump’s base, Cook is the perfect villain: an affirmative-action appointee elevated far beyond her competence, a living embodiment of the DEI regime they despise. By going after Cook, MAGA not only scored an optics win but also forced liberals into the awkward position of defending the very embodiment of affirmative action.

In politics, if you’re not on offense, you’re on defense.

For years, the American right mocked Saul Alinsky’s Rules for Radicals as the left’s dirty playbook. But in 2025, MAGA has adopted one of its sharpest tactics: isolate the target. To cripple a movement, you don’t attack it in the abstract—you pick one person, demonize them, and make them the embodiment of everything you oppose.

RULE 13: Pick the target, freeze it, personalize it, and polarize it. The opposition must be singled out as the target and "frozen." Obviously there is no point to tactics unless one has a target upon which to center the attacks.

— Rules for Radicals, 1971

That’s exactly the playbook the Trump administration is running here. Instead of challenging the Fed as an institution, they’ve picked the weakest member—Lisa Cook—and turned her into the symbol of everything they want to destroy. She’s been frozen in place, made to carry the weight of “woke” politics, and isolated so every attack, every ounce of energy, can be focused on her. The spectacle is the point. Cook is no longer a governor at the Fed; she’s a scapegoat, the lightning rod, the cartoon villain onto whom all the sins of DEI excess are projected. The brilliance of this approach is that the real action isn’t in the accusations themselves but in the backlash they create. Mockery, ridicule, and isolation spark a furious overreaction from the left, and that reaction only feeds and fuels the MAGA movement.

Lisa Cook will probably survive the mortgage fight… She just scored a major court victory (the judge was her sorority sister), and just released new documents showing that she labeled her Atlanta condo a second home (not as a primary residence), so Polymarket bettors now put her odds of being ousted this month at a mere 10%.

So, the Trump administration may have botched the execution of this hit. But the caricature—the “diversity hire” turned fraudster put in charge of America’s money printer—is already cemented. That image will outlast her, fueling the next purge of DEI America.

I’ll let you in on an open secret: Donald Trump wasn’t prosecuted because of mortgage fraud.

"If mortgage fraud were truly disqualifying, Washington would be a ghost town"

Isn't that also true of FARA violations?